after the upper middle class

things right now 038—week of 05.26.25

To alleviate our collective economic pain, 8Ball subscriptions are 20% off for the next month. Find the offer here: www.8ball.report/recession

The Coming Mass Unemployment or “A white-collar bloodbath”

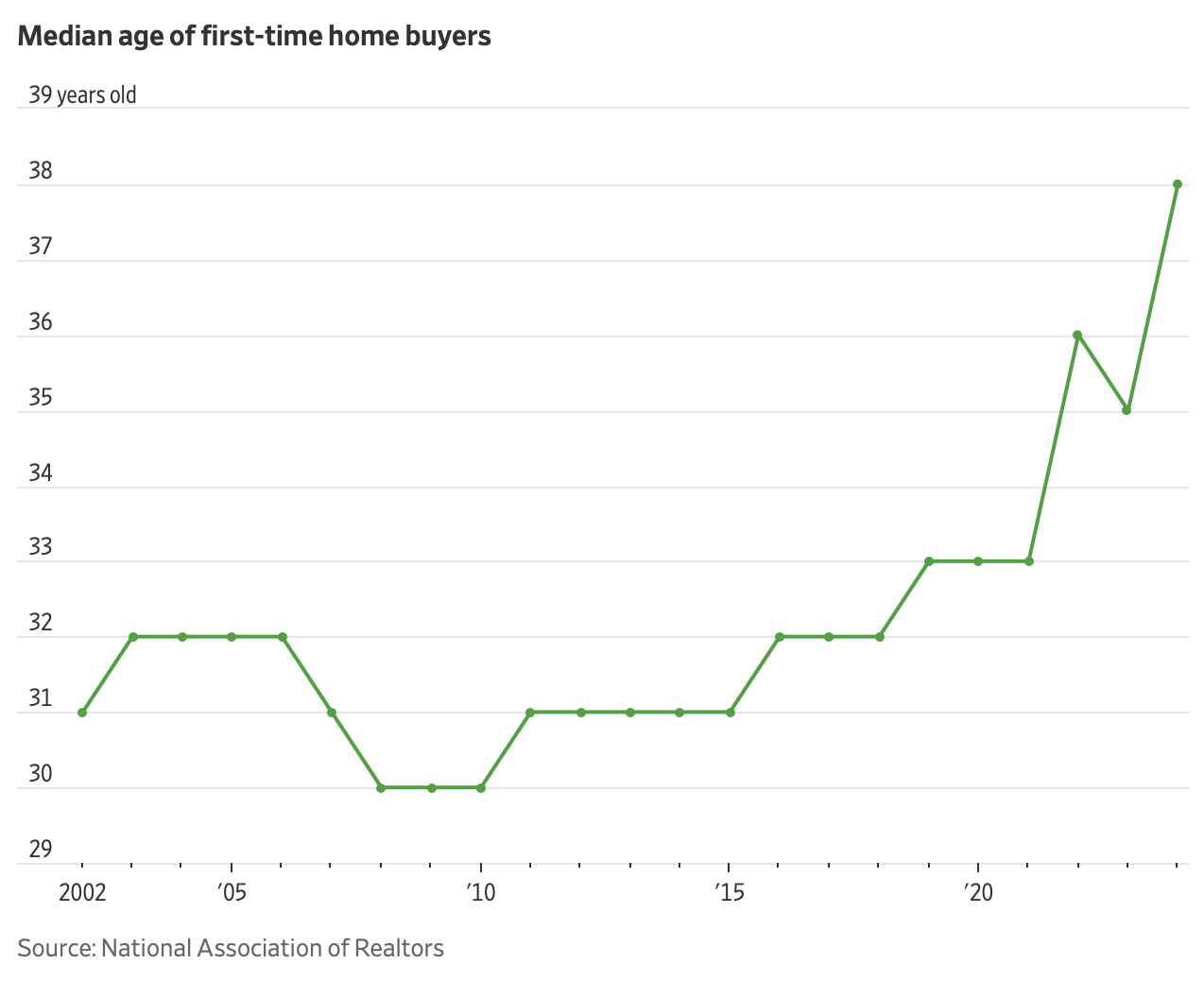

The 40-Year-Old Virgin or median age of first-time home buyers

New Liberal Messaging or the 'Abundance Agenda' loses to populism

Grow Revenue, Cut Costs or McKinsey’s mass layoffs

The Exception Proves the Rule or “Don’t bet against Elon”

A prediction:

AI eats into white-collar employment first—decimating the aggregate income of the upper middle class

Upper middle class unemployment nukes the U.S. real estate market—in particular the white hot urban and suburban markets clustered around America’s superstar cities

Real estate collapse nukes financial markets

Market collapse nukes the dollar

The U.S. federal government is forced…to do…something…

I’m not sure what the end of that story is—and, full disclosure, this is broad speculation. So let’s stress-test these assumptions.

During the last global financial crisis, when real estate collapsed, it took down the markets, which took down employment. Maybe the exotic derivatives our less than scrupulous financial class concocted out of mortgages were to blame and thus: this time is different. A friend in venture capital certainly thinks so.

Over dinner at The Smoke House, he argued real estate, especially the sort clustered around our superstar cities—New York, San Francisco, Washington, Boston, etc.— bounced back faster than many anticipated. We had another test of urban real estate durability just five years ago: COVID. Could a major global pandemic put a dent in housing costs? Not for long. The New York rental market keeps hitting record highs. San Francisco is back! and on track to best its pre-pandemic highs. Even London, facing the headwinds of fleeing millionaires, Brexit disruption, negative GDP-per-capita growth, and substantially lower incomes than their American cousins, is still in the running as the most expensive property market in the world, coming in fourth after Monaco, New York, and Hong Kong.

Touché.

But there’s a money-printer-goes-brrrr ouroboros at play: after the financial crisis and pandemic, central banks printed money—quantitative easing and ZIRP—lending cheaply to financial institutions. Those institutions pumped capital into profitable tech firms, hired ambitious grads at top dollar, and solidified today’s upper middle class. It goes without saying, this same policy also benefitted the billionaire class that owned the assets all this money was flooding into…

In both post-crisis eras, after the conspicuously transformation of federal monetary policy into salaries, IPOs, and a record-high stock market, the upper middle class and billionaires alike directed this money spigot into real estate.

Real estate is the ultimate positional good: finite homes near Silicon Valley, limited Manhattan apartments, scarce London flats. Add-in economic utility—the clustering of high-status jobs in just a few cities—and people overextend to stay. Thus the curious case of London, with its New York rents and not so New York salaries. Thus the stubborn millennial refusal to retreat to cheaper property markets and the concomitant rise in the median age of first-time home buyers.

But what happens when those jobs are gone?

Do the cities collapse?

Does the former upper middle class flee?

We find a clue in COVID-era Zoomtowns—picturesque villages near stunning natural beauty that saw startling appreciations in property values. (The Hudson River Valley emerged as the hottest real estate market in the United States.) Aggressive return to office policies cooled the flight from cities, but ultimately, the need for such aggressive return to office policies underscores that we often conflate the demand for urban living with the demand for a well-paying and high status jobs.

And emphasis should of course be on status. Money sometimes correlates with status, but as we see with culture industry careers, not always. The bigger issue when AI decimates the upper middle class won’t be lost income—it will be lost status. Hence stage five of my prediction not reaching the obvious conclusion: UBI or universal basic income.

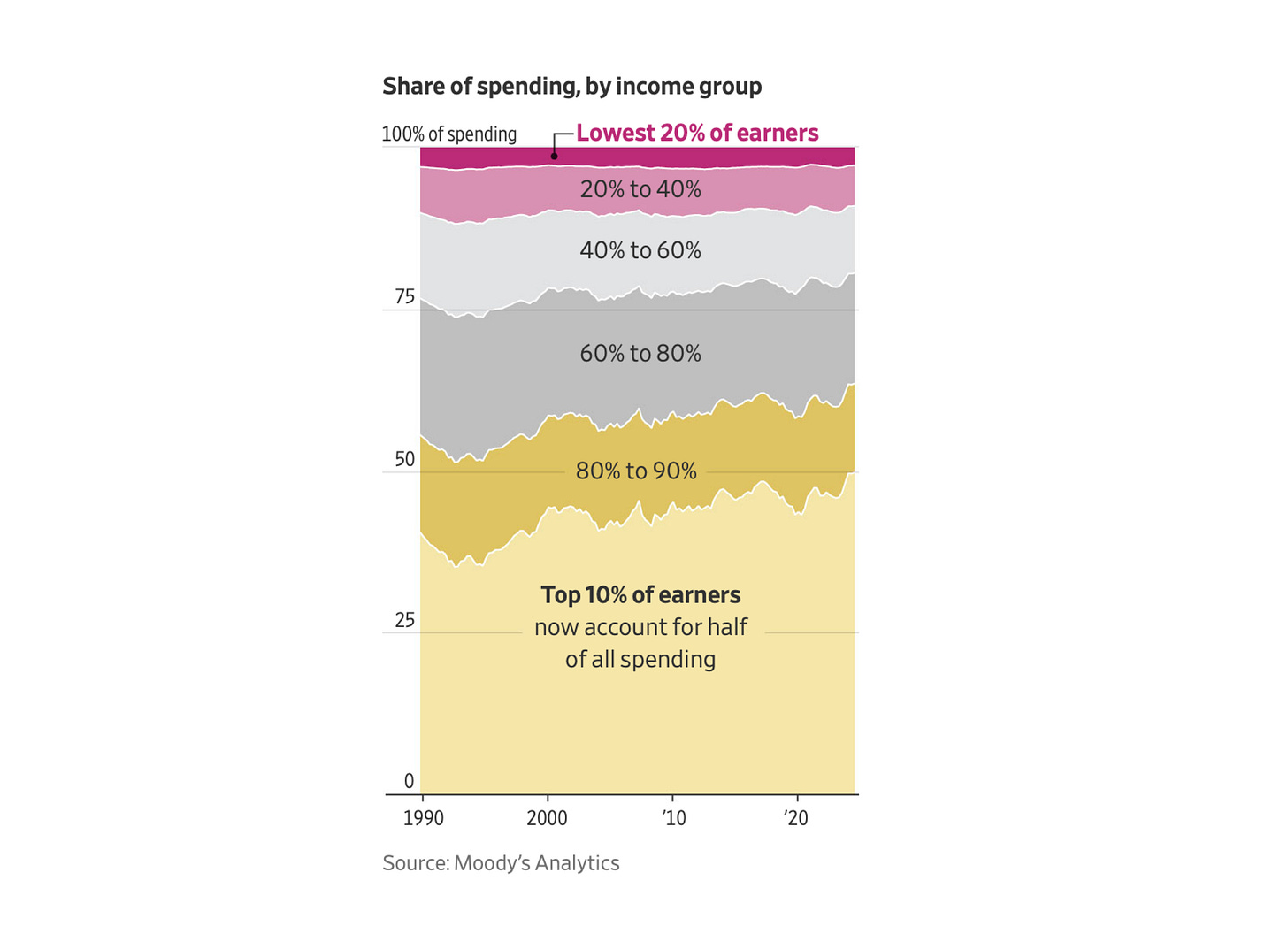

Let’s pause our focus on real estate. Maybe my friend is right. Maybe real estate is different. Maybe it won’t be a Zestimate plunge that craters the NASDAQ. Expanding our aperture, the market is doomed regardless. The upper middle class is responsible for the vast majority of consumer spending. The top 10% of American earners are responsible for 49.7% of consumer spending. That’s household incomes over $250,000. Include the next decile, the top 20% or those with household incomes over $165,000, and we come close to two-thirds of consumer spending.

When we beta-tested a universal basic income with 2020’s CARES Act, it mostly applied to overwhelmingly non-upper-middle-class, non-white-collar Americans who could not work from home, who did not have in common parlance "email jobs." For most of the beneficiaries—two out of three—the enhanced unemployment programs raised their incomes. And as any marketer can tell you, there was a palpable bump in spending, followed by an inevitable drop, along with the much-grumbled-about Biden era inflation.

Politically, it was still a bit of a hot potato. Businesses complained that the CARES Act disincentivized work. Beneficiaries preferred unemployment because it was paying them more than a job would. But logistically and politically, it was still much easier to replace the incomes of the poorest Americans than it ever will be to replace the incomes of some of the richest. In our populist moment, where "elite" connotes upper middle class as much as it does billionaire, which constituency (besides themselves of course) will champion their bailout?

Sure, the upper middle class is competent. They are conscientious and politically organized. They understand the sometimes ambiguous routes necessary to navigate academic and corporate bureaucracies. But will they be able to goad Congress into saving their McMansions?

I predict the "meritocratic" and "dynamic" nature of the American economy will make this problem harder to solve, rather than easier. In Britain, the modest salaries of the highly educated have become a meme and the best real estate in the country is an ancient inheritance. But in America, no one has a home in Brentwood because their family came over with William the Conqueror. There’s no divine right in California, no law that states an over-extended Senior Vice President at Meta should have their housing, consumption, and status subsidized by the federal government ad infinitum.

Ask an AI optimistic and they will tell you that artificial intelligence will herald a new age of abundance, that Optimus, the humanoid Tesla robot will do all the work, and our libertarian oligarchy will, entirely by accident, create the 2015 socialist meme: fully-automated luxury communism—or at a minimum that AI will be so exceptionally efficient, both government and the economy will deliver so much material wealth UBI will be a breeze to administer. Everything will be so cheap!

I’m skeptical we get to fully-automated luxury communism before we get to upper middle class implosion. Optimus will not be ready in time to save our oat-milk-swilling, Oura-wing-wearing comrades on the coasts. Furthermore, "abundance" as a solution to our society’s ills doesn’t even poll well. The Democratic party (or more specifically the progressive advocacy organization Demand Progress) has already begun testing the wonkish Ezra Klein version of "abundance," which boils down to "everyone would be less angry if housing, healthcare, and education was cheaper."

Here are the statements participants in the study were asked to respond to:

"The big problem is 'bottlenecks' that make it harder to produce housing, expand energy production, or build new roads and bridges."

"The big problem is that big corporations have way too much power over our economy and our government."

55.6% of those surveyed agreed with the second statement, the populist statement. Even worse: "Given a direct choice, 59% of Democrats preferred the populist argument, compared to just 16.8% liking the abundance one."

Democrats, the party of the upper middle class, do not trust Elon Musk to save America. They want Elon Musk’s head on a pike.

This tracks with the general sentiment I see amongst the remaining progressives on X. There’s a real frothing anger at big tech, at Elon, at Trump. That’s nothing new. But also a sense that the poor labor market for recent college grads, specifically, and the white-collar upper middle class, more broadly, is a direct outcome of policy. The blue-collar-coded MAGA coalition is a punishing the white-collar-coded upper middle class, the new base of the Democratic Party.

There’s some truth here. The intention—if not the outcome—of the tariffs is certainly to grow middle- and working-class incomes. The Trump administration is going after colleges and universities. There’s more than a whiff of class war about it.

But is that why McKinsey laid off 10% of its workforce in the last 18 months? No. Probably not. McKinsey is doing what every business is doing: testing just how many first year analysts they can do without. Whether or not class war is the culprit won’t matter though. What will matter? The political narrative. And that political narrative will be:

Tech killed the progressive upper middle class.

Keep reading with a 7-day free trial

Subscribe to 8Ball to keep reading this post and get 7 days of free access to the full post archives.